How to Get Your Home Ready to Sell

For those of you who prefer to read, here is a transcription of my videoRead More

Did you know? Declutter your book collection, make an impact

We've worked in many homes with large personal libraries - which is great! In myRead More

How to Declutter Your Home in 10 Easy Steps

For those of you who prefer to read, here is a transcription of my videoRead More

Organizing for the post-holiday season

The winter holidays have come and gone. Don’t feel bad if that means your homeRead More

How to organize your garage

Before we get into how, we have to start with why do you want toRead More

Did you know? NAPO-CT is collecting for pets

I’m excited to share with our clients, and any readers who are interested, that MattRead More

Organizing For Small Spaces

How do you organize your space when there is no space? I was asked thisRead More

Holidays Made Easy: Organizing tips for the holidays

For those of you who prefer to read, here is a transcription of my videoRead More

Did you know? Responsible medication disposal

These days it can seem like there is an infinite number of medications outRead More

Did you know? New life for old paint

Paint. We all hang on to it. You painted your kitchen 15 years ago? YouRead More

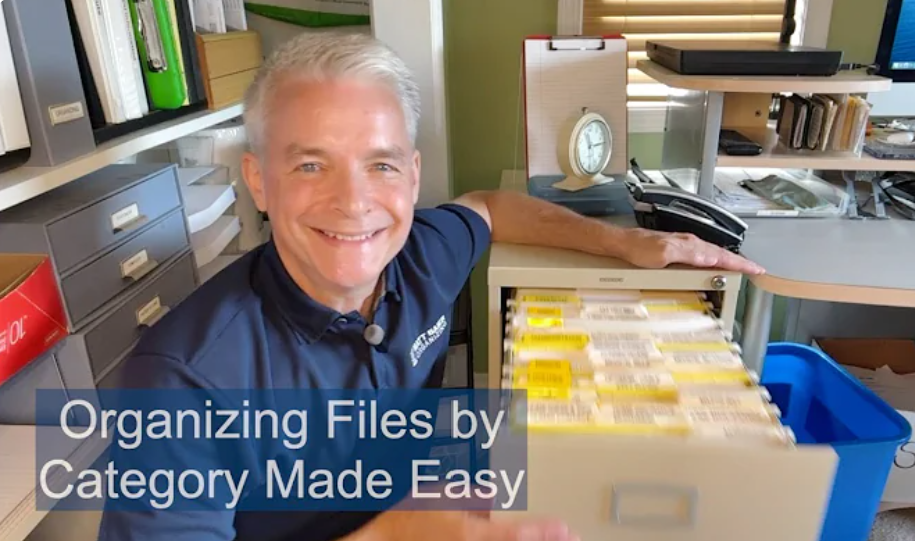

Organizing Files by Category Made Easy

For years I have recommended the book, File Anything in Your Home: And Find ItRead More

Did you know? You can Recycle for Rewards

This post comes to you from team member Gabrielle House As I sit here typingRead More

5 Steps to an Organized Bathroom Closet

This post comes to you from one of our talented team organizers Gabrielle "Gab" House.Read More

Decluttering Email Made Easy

Like to easily declutter your email inbox? For those of you who prefer to read,Read More

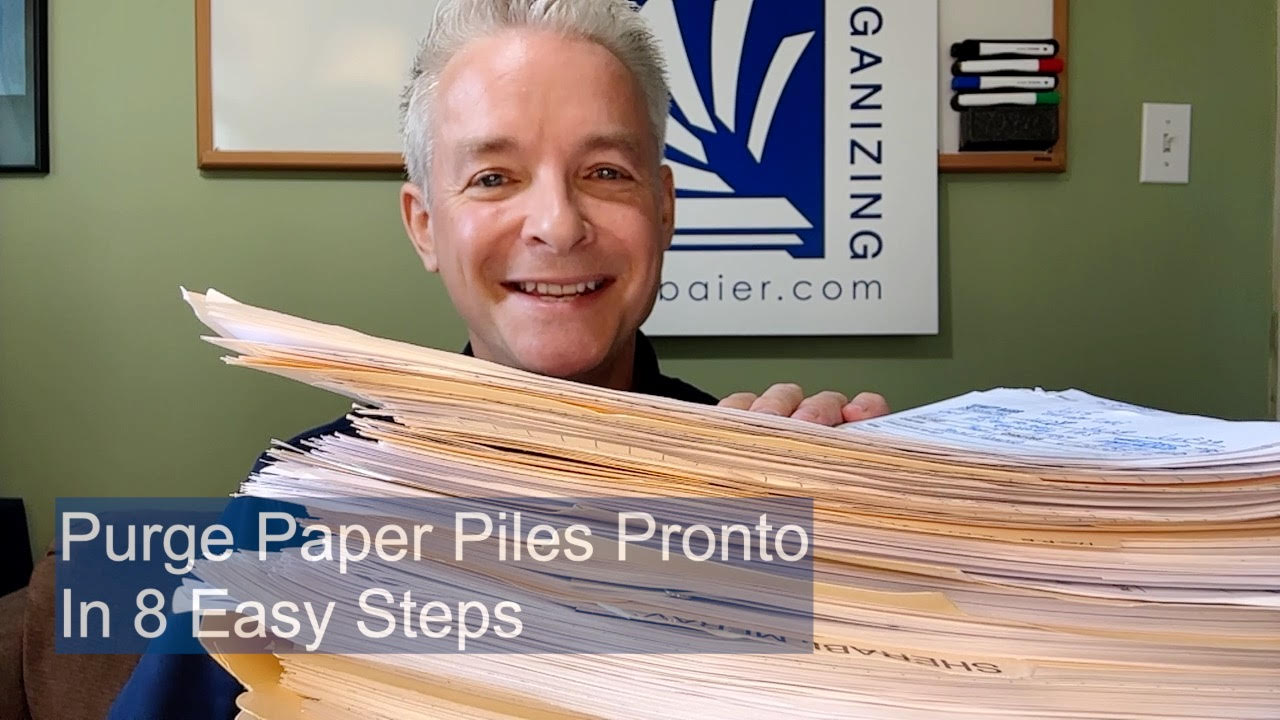

Purge Paper Piles Pronto in 8 Steps

For those of you who prefer to read, here is a transcription of my videoRead More