When should you scan? and when should you shred?, aren’t the first questions you should ask when organizing paper. However, clients often ask these questions early on in the conversation, so I am going to answer them. I understand the frustration that leads to these questions. The paper accumulation is overwhelming. They client has had it and believes there has to be a better way. There is a better way, but it doesn’t start with the technology. If you’re in a war with paper, here is the best way to launch an attack.

1. Cut the overwhelm

In almost every cluttered home office we enter, we find files mixed with reading material and advertising. Start by sorting these basic categories very quickly. Don’t look at content yet. The idea is to extract the less important stuff so that you can focus on the more important stuff. This would include bills to pay, statements, information, and records. Much of what piles up in an office turns out not to be documents at all. Things like office supplies, stationery, computer supplies and owners manuals all give a false sense of overwhelm. They simply need better homes, but that is a subject for another post. Using this attack, you can quickly conquer half the battlefield.

2. Prioritize first

Before you even get out the file folders, do another fast sort. I’m talking just four essential stages, which I call running, sitting, sleeping, and dead files.

Running files are the ones that require action, bills to pay, etc. Don’t take action. For now, just sort!

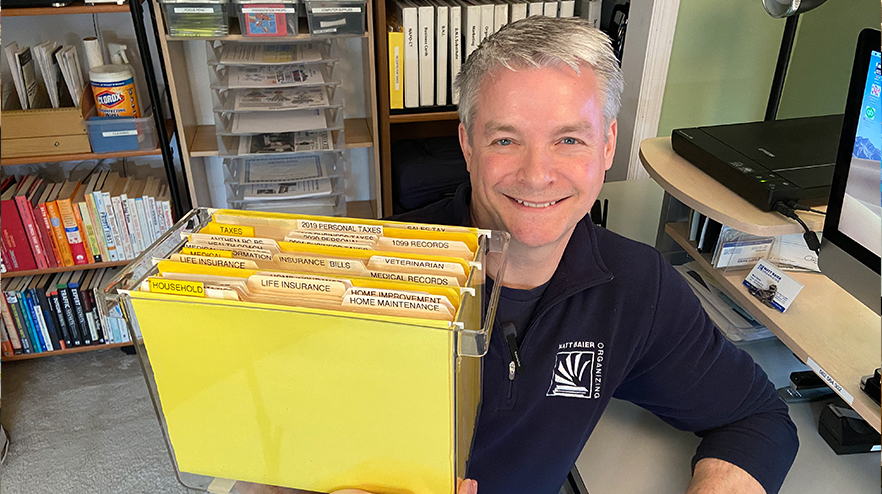

Sitting files are files that you need to be able to find quickly. They should eventually go to a file cabinet, within arm’s reach from your desk.

Sleeping files may be the most important stage to recognize, because they can free up the most space. These are files that you are keeping just in case, but you are unlikely to access. There tends to be way too many of these in your arm’s reach. Not deducting any items for taxes? You can cut your sleeping files down even further. Here are the IRS guidelines on how long to keep. Sleeping files can go in your basement or attic. Remote need merits remote location.

Dead files have lost all value and should be discarded. To be on the safe side, tax-supporting material that you have in sleeping files can be discarded after 7 years. Note: this doesn’t include the actual tax return and bank statements. They don’t take up much space and should be kept indefinitely.

A system for running files can fit on top of one file cabinet and sitting files go in the file cabinet. The sleeping files go somewhere remote and the dead files go out. Period.

3. Don’t scan what you can de-prioritize

After you cut the overwhelm and prioritize, there should be no paper on your surfaces or floors. Suddenly, the urge to “scan everything!” will subside. That said, there are times when it makes sense to have digital files. Each stage of paper comes with its own considerations.

In the running stage, most of my clients are already paying bills online, so that’s nothing new. However, receiving invoices digitally can be a problem. As much paper mail as we get, we get way more digital mail. I experimented with the “paperless option” and promptly switched back to paper bills. Too many bills were getting lost in my daily deluge of email. Action items should be as compelling as possible. I love trees, but I hate late fees more.

In the sitting stage, you also have to look critically at the advantages of going digital. With sitting files, find-ability is king. That’s one of the key advantages that proponents of scanning cite. I use a filing system that makes files very find-able and rotate-able.

I find it faster to retrieve a paper file than a digital file, so there is no point in scanning. Bear in mind, that although scanners have gotten much faster, scanning is still a project that requires time. Don’t make the mistake of thinking that going digital, suddenly makes everything automatic. A digital filing system still requires the participation of the user. Still, if you trust your ability to find digital files, this would be a valid reason to scan.

In the sleeping stage, I think it’s a waste of time to do too much scanning. In the first place, these files aren’t taking up prime real estate in your home. Second, the need to find them is unlikely, so I don’t think it merits the time. Still, to be on the safe side, there are some notable exceptions. Bank statements and year end credit card statements are worth scanning, if you don’t already have them digitally. You might also want to scan your actual tax return, if it’s not already an e-file. Most important to scan are the cash receipts, if you are itemizing. These, of course, won’t show up in your bank statements and credit card statements.

In the dead stage, be sure that what you have tossed is backed up digitally. If the IRS comes looking for an old file, you are responsible for producing it. You’ll be covered with the basics I just mentioned, but they need to be in a safe place. Your digital files should be backed up and in two separate locations.

4. Don’t shred what you can recycle

While it is true that identity theft has gotten worse, overreacting can be a misdirection of concern. The information that puts you most at risk is your active credit card numbers and you social security number. By all means, make sure these are safely shredded. However, your address is easily available online. To destroy every document with your address on it, is a lot of work for minimal gain. It should not be mixed up with the credit card numbers and social security numbers. This quantity can lower the odds of shredding the more vital information.

There is a far greater benefit to sorting the daily mail daily than there is in shredding all your paper. If you do want to shred it all, you may want to consider a shredding service. You can spend a lot of time with a personal shredder. It overheats and jams up and eats up precious time, better spent elsewhere. Once the decision to shred has been made, the shredding process does not require your unique knowledge. Shredding can, and maybe should, be delegated.

As with any war, the war on paper does not depend on technology alone. It must start with the right strategy, to limit your sacrifice. With paper, the sacrifices that you want to limit are time, energy, and space. The right strategy not only ensures victory, but also addresses its maintenance. So you might say the ultimate goal is to make peace with paper.

Would you like help making “peace with paper”? We’d be happy to help. For new clients, you can save money on our organizing services with The Paper Escaper Special.

Please Share With Your Community